EZ Check Printing Crack + Product Key

EZ Check Printing Crack is an easy-to-use payroll software specially designed for small businesses: simple, reliable, and affordable. Our developers designed it as an in-house payroll tax solution for small businesses to calculate taxes, print employee and contractor paychecks, generate reports, and print tax forms. No internet connection is required to process paychecks. Calculates federal and state payroll taxes/deductions and local taxes (such as SDI, business tax, municipal tax) Prints paychecks and tax forms Support salary, hourly rate, commission, tip, and custom wages (such as piece-rate, stop-time, and mileage-based pay) Flexible tax options for W2/1099 employees and special-needs church and nonprofit employees.

ezPaycheck small business payroll software is designed with simplicity in mind. It is easy to use even for people without an accounting background. Once you have installed this paycheck software on your computer, you can click on the Add button to add your first paycheck. You can follow the steps below to customize it for your business. Click on the left menu “Company Settings->Company”.Enter company information. Select the payment period. ezPaycheck can support daily, weekly, bi-weekly, semi-monthly, and monthly pay periods. Save your changes. Click on the left menu “Company Settings->Tax Information”. Enter Company Tax ID, W3 Control Number, W3 Business ID, and State Unemployment Tax Rate. Save your changes.

You may also like this Vocaloid Crack

EZ Check Printing Crack Features

- Create paychecks for W2 employees;

- Create paychecks for 1099 contractors;

- Create paychecks for employees with special tax settings (ex: expatriate employees, clergy)

- Create the following paychecks

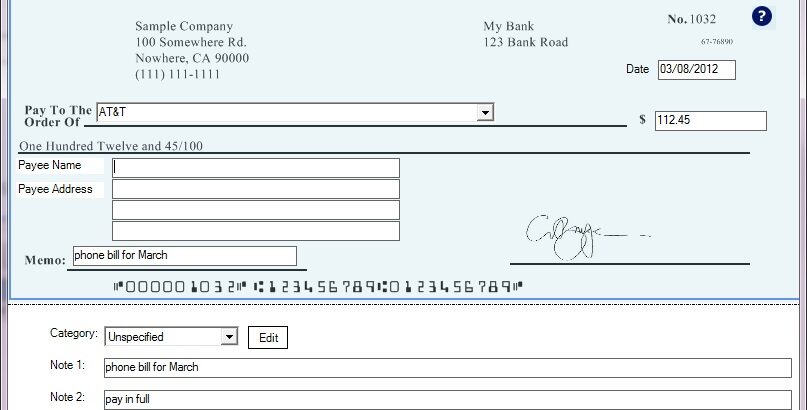

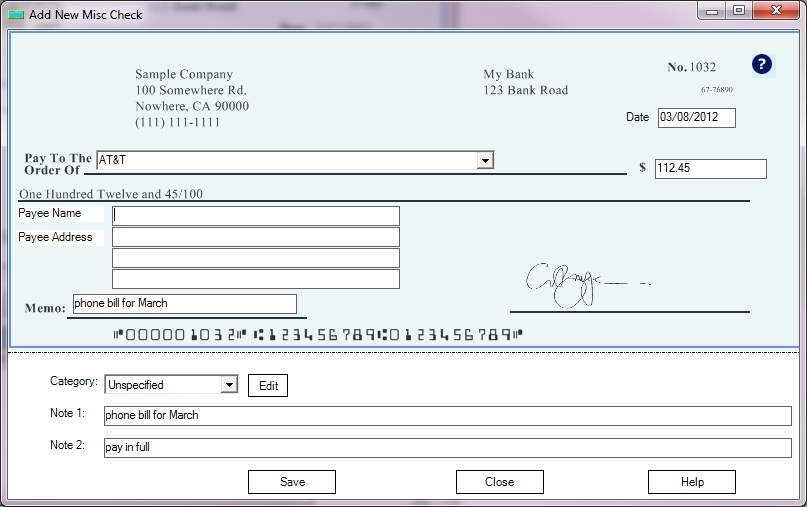

- Create MISC checks (to pay reimbursements and supplier invoices)

- Print W2, W3, 941 and 940Designed for small business owners;

- form-level help buttons;

- Easy-to-follow wizards guide you through the process of setting up a business and setting up employees;

- integrated federal and 50-state tax tables;

- Automatically calculates federal employer withholding tax, state tax, Social Security, Medicare tax, and unemployment tax;

- Supports local taxes;

- Supports additional federal and state tax withholding options;

- Supports 401k, retirement savings, insurance deductions, and more

- Employers can add custom tax and deduction fields; Pay salary or hourly rate;

- Supports bonuses, commissions, tips EZ Check Printing Product Key

- Employers can add custom payments such as pay per piece, pay per load, pay per project, pay per kilometer, etc.

- Supports different pay rates for different shifts or tasks

EZ Check Printing Crack System Requirements

- Prints blank paychecks and pre-printed checks;

- Prints MICR coding on plain paper

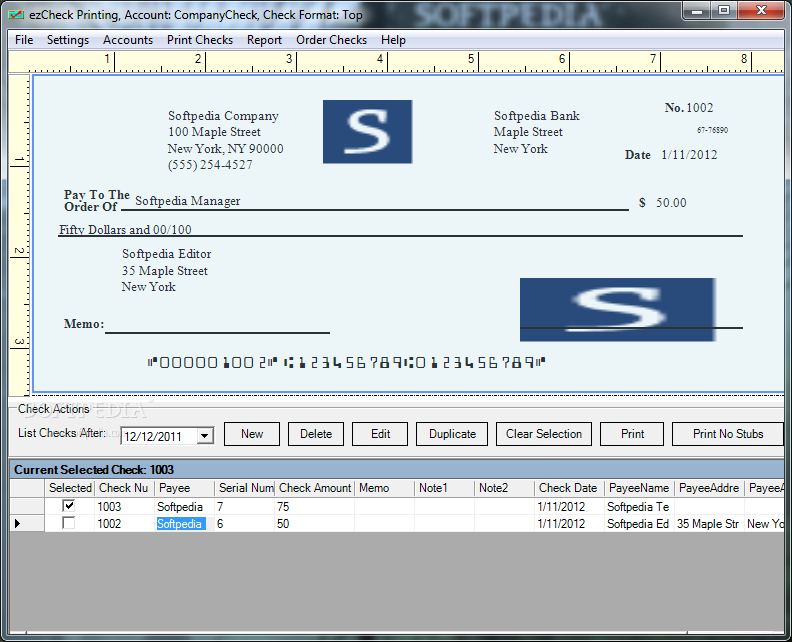

- Supports multiple paycheck formats: middle save, top save, bottom save, and 3 per page;

- Customize paycheck with logo, signature, two signature lines, and additional fields

- Supports option to hide social security number

- Displays year-to-date taxes, deductions, and details on stubs

- Supports option to print only stub forms and reports

- Calculates and prints Forms 940, 941, W-2, and W-3; (Note: Red forms are required to print W2 A and W3 copies.)

- Friendly employer and employee relations; 30-day free trial available;

- No monthly fees;

- Buy payroll software now and get the key code instantly;

- no hidden fees

- Free email and live chat support; Click on the left menu “Staff-> Add staff”.

- Enter the employee’s name and address EZ Check Printing Activation Key

- Employees can be paid on the basis of an annual salary or an hourly rate.

- Specify tax options.

- Save your changes. Designed for small business owners;

- form-level help buttons;

- Easy-to-follow wizards guide you through the process of setting up a business and setting up employees;

What’s New EZ Check Printing Crack

- Integrated federal and 50-state tax tables;

- Automatically calculates federal employer withholding tax, state tax, Social Security, Medicare tax, and

- unemployment tax;

- Supports local taxes;

- Supports additional federal and state tax withholding options;

- Supports 401k, retirement savings, insurance deductions, and more

- Employers can add custom tax and deduction fields; Pay salary or hourly rate;

- Supports bonuses, commissions, tips

- Employers can add custom payments such as pay per piece, pay per load, pay per project, pay per kilometer, etc.

- Supports different pay rates for different shifts or jobs Prints paychecks on plain paper and preprinted checks;

- Prints MICR coding on plain paper

- Supports multiple paycheck formats: middle record, top record, and bottom record;

- Customize paycheck with logo, signature, two signature lines, and additional fields

- Supports option to hide social security number

- Displays year-to-date taxes, deductions, and details on stubs

- Supports option to print stubs only

How to install it?

- 30-day free trial available;

- No monthly fees;

- Buy payroll software now and get the key code instantly;

- no hidden fees EZ Check Printing Serial Key

- Free email and live chat support; Yes, ezPaycheck is designed for small businesses and is very easy to use.

- You can download and try it for free for 30 days. No credit card is required and no obligation. The trial version comes with the sample database.

- This is how you can print the first check after installation.

“We offer simple and affordable payroll software that allows small businesses to do their payroll tasks in-house. - Many small business owners don’t know much about payroll taxes and don’t have the time to invest in training.

- They also don’t need complicated features, but still need to do things like paycheck processing and tax reporting,” said the EzPaycheck software development team,

- “Our goal is to make ezPaycheck as simple and user-friendly as possible, while still providing the robust functionality that our customers need.

- “Yes. ezPaycheck is very user-friendly and easy to use.

- We intentionally developed this software for customers who are not professional accountants and payroll tax experts.

- You are welcome to try the trial version of 30 days no obligation No credit card required If you have any questions, stay tuned, we’re here to help.

Conclusion

The single-user version of ezPaycheck costs $139 per calendar year per installation. It can support unlimited companies, employees, paychecks, and tax forms at no additional cost. You can click on the link above to learn more. A laser printer (or MICR printer) is required to print checks on plain paper. If you only print check data on preprinted checks, you can use any printer. Many of our customers prefer to use office/home laser printers. However, MICR (Magnetic Ink Character Recognition) printers print checks with the best quality. We do NOT recommend inkjet printers for printing blank checks, as we have found that some ATMs and grocery stores may not be able to scan checks if they use the older scanners EZ Check Printing Vst.

The trial version is the full version with the only limitation that it prints test images on checks, W2, W3, 940, and 941 forms. It stops working after 30 days unless you purchase and register the Licence. (All your data will remain after license registration.) Yes! You can print copies B, C, and D of Form W-2s in their entirety and ready to use on plain paper. You can print the W-2 A and W-3 copies on preprinted forms in red ink. Yes, ezPaycheck can support an unlimited number of companies and employees. ezPaycheck costs $139 per calendar year per install. If you edit multiple companies from the same machine, there is no additional charge. However, if you install ezPaycheck in multiple locations, you must purchase a multi-user license.